Programme Overview

Dr Bhaskar Bhowani

Head, PGDM

(Financial Management)

Factors such as globalization, deregulation, mergers and acquisitions, competition and technological innovations have forced companies to rethink their business strategy. In today’s ever-changing business environment, finance executives are exploring ways and means by which the financial function can bring greater value to their organizations. Finance executives today need to think beyond the traditional financial information contained in general ledger system and consider how best to provide comprehensive measures and analytical methods needed to drive decisions inside the complex and dynamic companies.

To serve the needs of the changing horizons in financial dynamics of the industry, the course on “Post Graduate Diploma in Management – Finance” helps to build an elaborate knowledge on finance, accounting, taxes / tax structures and the relations of all these aspects on overall business dynamics of complex Industries. The basic aim therefore is to develop skill and knowledge in the financial domain.

The primary objective of the course is to impart knowledge and skill and, just as important, to transmit certain values. The institute proposes to make the students aware of the occupational mobility and voluntary compliance to ethics, law and social responsibilities.

In this context, not only the imparting of knowledge and skills is of vital importance, but even more crucial is the purpose for which the knowledge and skills are utilized. This will greatly depend on the values that students carry with them once they graduate from the institute.

In general the programme helps the students to equip themselves with the knowledge, skills and values. This is by way of:

-

Acquainting the students with the problems of today’s business environment that has become very dynamic and competitive. This is done by broadening of horizons by making available information in the form of books, business magazines and research reports.

-

To equip the students with the right attitude, knowledge, and skills in areas of business management and information technology necessary to succeed in the data-intensive VUCA environment.

-

Developing decision making skills, analytical skills and logical reasoning through interactive class room lectures and discussions, individual and group assignments, case study analysis, individual and group presentations, live projects, company internship and class room participation.

-

Developing the communication and interpersonal skills of the students so that they can express themselves clearly and with confidence in order to convince others. Students are also trained to be good listeners who are sensitized to the expectations of others so that they can play an effective role in group situations. This is done through the communication labs.

-

Organizing of rural camps in rural areas thereby imparting an understanding of the deeper aspirations of the common people for justice and who should see their training as a preparation for true service to the society. The perfect blending of humanity and professionalism, the amalgamation of management, leadership and social service is the unique objective of this esteemed institution that creates, “Professionals with a difference.”

The PGDM-Finance Programme of XISS is designed to achieve the following programme educational objectives and programme outcomes:

About PGDM Finance Programme

The programme Post Graduate Diploma in Mangement – Finance (PGDM – Finance) at Xavier Institute of Social Service, Ranchi (XISS) is a two-year full time Finance Management Programme. The programme augments the understanding of the role of financial managers in business and society. It helps to enable the students internalize the key business concepts, learn to analyze problems, develop strategies, communicate ideas and motivate people to action. Emphasis is placed on developing analytical mind, which seeks the right knowledge and skill with right leadership attitude.

It is thus expected that the course instructors as well as the students will pay attention to the integration of the subjects of various trimesters with the objective of the curriculum.

Programme Educational Objectives (PEOs)

-

To provide solid foundation in analytical, scientific and financial fundamentals required to solve business problems, carry out research and pursue higher studies while striking a balance between commercial and social dimensions in profession.

-

To develop and train students in a way that they become industry leaders and are able to lead the Financial sector with due emphasis on sustainability and development.

-

To inculcate the entrepreneurial abilities amongst students with continuous emphasis on moral and ethical values and empowerment of the marginalised.

-

To enable students develop comprehensive understanding of interdisciplinary linkages of the programme with the objective of grooming competent professionals with conscience and compassion.

Programme Outcomes (POs)

-

Apply Knowledge of management theories and practices to solve business problems.

-

Foster analytical and critical thinking abilities for data-based decision making.

-

Ability to develop value based leadership ability.

-

Ability to understand, analyse and communicate global, economic, legal and ethical aspects of business.

-

Ability to lead themselves and others towards the achievement of organisational goals, contributing effectively to a team environment.

-

Prepare students to excel and succeed as finance professionals through intensive education and exposure and also make them aware of their responsibility towards the society.

-

Describe the role of financial manager and importance of financial systems in organisational context to efficiently use the resources of an organisation.

The department reserves the right to modify, update or delete a subject or a part of the subject in order to maintain the relevancy of the course. All modifications are subject to the approval of the Board of Studies.

Course Structure for PGDM (Finance)

Trimester – I |

|

|---|---|

|

Business Statistics – I |

|

|

Accounting For Managers – I |

|

|

Economic Environment of Business |

|

|

Essentials of Management |

|

|

Business Communication |

|

|

Marketing Management |

|

|

Communication Lab |

|

|

Soft Skill Development & Business Sessions |

|

|

Viva-Voce |

|

Trimester – II |

|

|---|---|

|

Research Methodology |

|

|

Accounting For Managers – II |

|

|

Financial Management – I |

|

|

Business Statistics – II |

|

|

Organisational Behaviour – I |

|

|

Business Law |

|

|

Soft Skill Development & Business Sessions |

|

|

Viva-Voce |

|

Trimester – III |

|

|---|---|

|

Micro Economics For Managers |

|

|

Financial Management – II |

|

|

Cost & Management Accounting |

|

|

Operations Research |

|

|

Financial Markets & Services |

|

|

Marketing of Financial Services |

|

|

Organisational Behaviour – II |

|

|

Rural Exposure (Camp) |

|

|

Human Resource Management |

|

|

Soft Skill Development & Business Sessions |

|

|

Viva-Voce |

|

Trimester – IV |

|

|---|---|

|

Principles & Practices of Banking |

|

|

Customer Relationship Management |

|

|

Soft Skill Development & Business Sessions |

|

|

Viva-Voce |

|

|

Insurance & Risk Management (Elective) |

|

|

Behavioural Finance (Elective) |

|

|

Certification Courses in NISM (Elective) |

|

|

Valuation & Financial Modelling (Elective) |

|

|

IT Skills For Managers (Elective) |

|

|

Logistics & Supply Chain Management (Elective) |

|

|

Basic Econometrics (Elective) |

|

|

Public Finance (Elective) |

|

Trimester – V |

|

|---|---|

|

Macro Economics For Managers |

|

|

Business Ethics & Corporate Social Responsibility |

|

|

Financial & Tax Planning |

|

|

Industrial Visit |

|

|

Soft Skill Development & Business Sessions |

|

|

Viva-Voce |

|

|

Micro Finance (Elective) |

|

|

Development Administration (Elective) |

|

|

Investment & Portfolio Management (Elective) |

|

|

Project Management (Elective) |

|

|

Financial Derivatives (Elective) |

|

|

Investment Banking (Elective) |

|

|

Ethics in Finance (Elective) |

|

|

Total Quality Management (Elective) |

|

|

Decision Making in Business (Elective) |

|

Trimester – VI |

|

|---|---|

|

Summer Internship Report – Final Evaluation |

|

|

Summer Internship Report – Viva-Voce |

|

|

Grand Viva-Voce/Overall Assessment |

|

|

Finance in Practice (Elective) |

|

|

Personal Financial Planning (Elective) |

|

|

International Financial Management (Elective) |

|

|

Applied Econometrics for Finance (Elective) |

|

|

Retail Management (Elective) |

|

|

Sales & Salesmanship (Elective) |

|

|

Consumer Behaviour & Market Analytics (Elective) |

|

|

Strategic Financial Management (Elective) |

|

|

Corporate Finance (Elective) |

|

|

Business Policy & Strategic Management (Elective) |

|

|

Financial Engineering (Elective) |

|

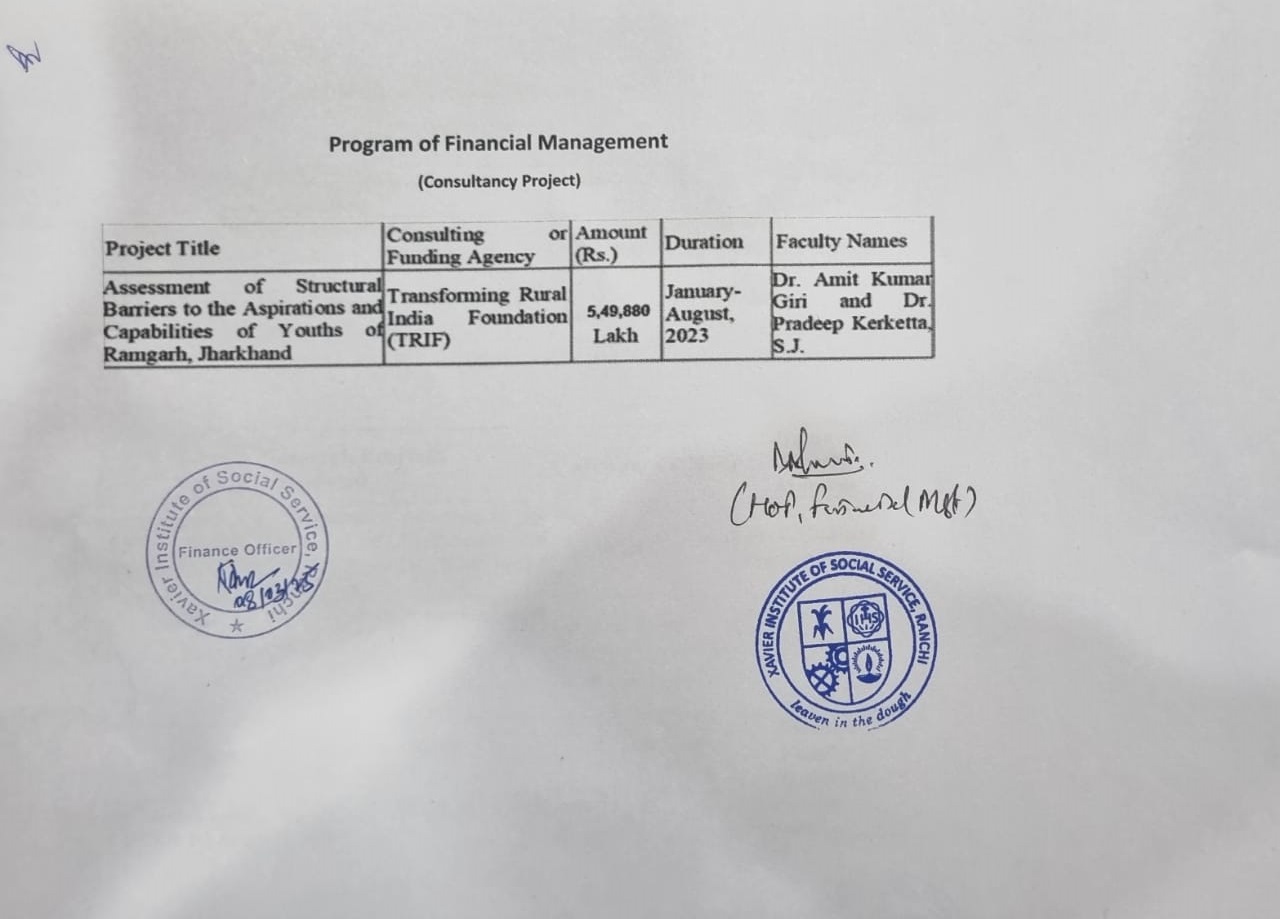

Consultancy Details

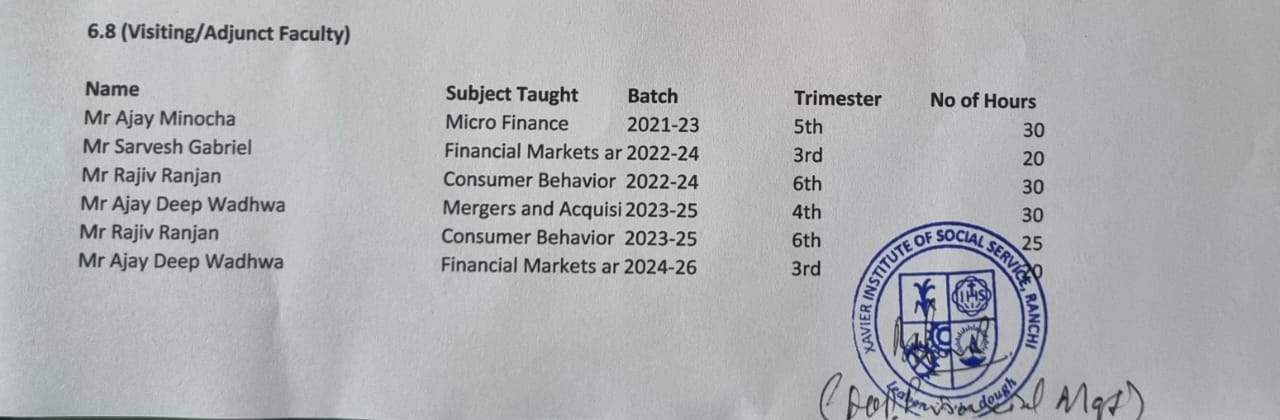

Visiting Faculty